Hospital executive compensation: Salaries rise, bonuses dip

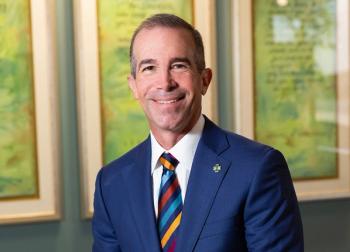

Health systems face stiff competition for leadership roles, but incentive pay falls as hospitals continue to face challenges. Bruce Greenblatt of SullivanCotter talks about trends in leadership pay.

Healthcare organizations are vying to find talented executives at a time when there is high demand.

“The market for executive talent is extremely competitive,” says Bruce Greenblatt, executive workforce practice leader at SullivanCotter, a consulting firm that examines compensation in healthcare and nonprofit organizations.

This year, healthcare executives received a 4.1% increase in compensation on average, according to SullivanCotter’s annual report on executive compensation, which was released last week. That’s down from 4.3% in 2022.

Among hospital and health system executives, the median increase in their salaries was 4.8% in 2023.

But as many health systems continue to struggle, executives also received less in bonuses and other incentives. The total cash compensation, which includes incentives, rose by 3.5% in 2023, according to SullivanCotter, which surveyed 3,000 organizations.

“Incentive payouts were actually lower coming into 2023 than they were a year ago,” Greenblatt tells Chief Healthcare Executive®.

Many health systems continue to see

“Organizations are balancing what's a very competitive talent market with the realities of the performance environment overall,” Greenblatt says.

Health systems are expected to offer attractive salaries next year due to the tough competition for leaders, but incentive pay or bonuses could again be modest, since they are tied to the performance of their organizations. “This competitive dynamic is continuing into 2024,” Greenblatt says.

With hospitals and health systems not consumed with the daily crises of the height of the COVID-19 pandemic, it’s clear that organizations are doing more long-term planning and looking for leaders.

The number of organizations that are doing more recruiting of executives is six times higher than those that report they are doing less searching, Greenblatt says.

“That's indicative of the level of need, the level of demand for talent, that really frankly is outstripping supply of talent,” he says.

Certain leadership positions are in particularly high demand, Greenblatt says. Hospitals and health systems are seeking executives in operations positions, health equity and population health, he says. Chief quality officers and patient safety leaders are also in high demand.

“We have seen increases in demand for a lot of jobs that are mission critical, as organizations are now in a sort of post-pandemic operating mode,” he says.

Health systems are also anxious to find leaders in digital roles, from expanding digital health options to cybersecurity positions.

Those executive positions in particularly high demand are also seeing higher salary increases than other roles, Greenblatt says.

Some healthcare organizations are also increasingly willing to recruit executives from other industries for roles in cybersecurity, as well as finance, human resources and marketing.

“We're seeing a broadening of talent markets,” Greenblatt says. “So healthcare organizations are recruiting from general industry and other sectors that are outside traditional healthcare. And that's because first off, for cybersecurity, that's where a lot of the talent is, but also just practically because the demand for these roles is high. Organizations are finding that they have to extend and be more flexible in terms of the industries that they're recruiting from.”

Health systems need to be more flexible to find the best talent, particularly in roles of high demand, Greenblatt suggests.

However, hospitals also need to be willing to adjust their compensation offers when they’re trying to recruit, he says.

He also says organizations should focus on finding leaders that really understand the purpose and value of hospitals and health systems.

“Never lose sight of the mission, in the purpose of what institutions are doing because there's a big, big draw to that,” Greenblatt says. “And that's really just such a critical differentiator for organizations in this space.”

Health systems also face growing attention for how much they are paying their executives. In some contract disputes this year, union leaders have pointedly commented on the pay of hospital executives while they bemoan the compensation of healthcare workers.

The Lown Institute, a think tank that has criticized hospitals for their spending practices, released a 2022 report outlining

Hospitals recognize that they are facing more scrutiny over the compensation of executives, Greenblatt says. He says organizations are looking more closely at pay equity and looking at pay alignment throughout their systems.

“We're seeing very much a focus on equity, to ensure that the broader workforce, whether it's through salary increases or at-risk pay is taken care of exactly like the leaders are, to make sure that there's competitiveness throughout the organization,” he says.