- Politics

- Diversity, equity and inclusion

- Financial Decision Making

- Telehealth

- Patient Experience

- Leadership

- Point of Care Tools

- Product Solutions

- Management

- Technology

- Healthcare Transformation

- Data + Technology

- Safer Hospitals

- Business

- Providers in Practice

- Mergers and Acquisitions

- AI & Data Analytics

- Cybersecurity

- Interoperability & EHRs

- Medical Devices

- Pop Health Tech

- Precision Medicine

- Virtual Care

- Health equity

Andreessen Horowitz Starts $450M Tech-Heavy Bio Fund

Why the venture capital firm is betting on the “ability to engineer biology.”

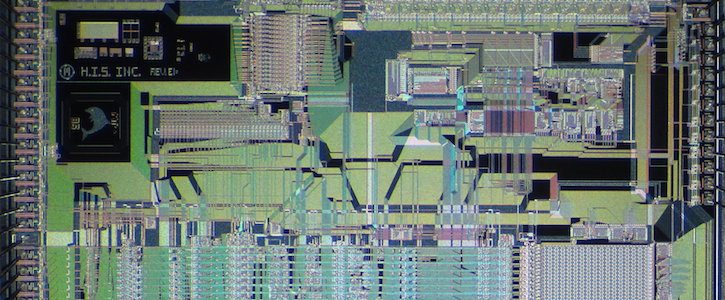

Image has been resized. Credit: Paul Rautakorpi, Wikimedia Commons

If you ask the financial brains at the venture capital firm Andreessen Horowitz, there is plenty to be excited about in the biology and engineering space.

The mushrooming field is so exciting, in fact, that the company has earmarked $450 million for investment in fledgling start-ups and established success stories alike, according to a recent announcement. The money is slated to support innovators working in computational biomedicine, using artificial intelligence to improve diagnostics and therapeutics; companies focused on creating DNA tools, enabling them to “program and design” organisms; and outfits aiming to enhance healthcare value.

“And it’s just the beginning,” Jorge Conde and Vijay Pande, general partners at Andreessen Horowitz, wrote of the intersection of biology and engineering. “We believe that bio today is where information technology was 50 years ago: on the precipice of changing nearly every industry, touching all of our lives.”

The move follows the firm’s initial $200 million bio fund, which it created in 2015, in pursuit of projects that stood to disrupt medicine through machine and deep learning. That effort saw Andreessen Horowitz make 12 investments in up-and-comers that are targeting the early detection of cancer and heart disease, patient coordination, and safer food science, according to the organization. Recipients are using their funding to advance artificial intelligence (AI) in wearable technologies, diagnostics, and therapeutics, the firm’s representatives noted.

Continuing to eye AI, they molded the new bio fund while considering a “foundational shit in biology” from empirical science to an “engineered discipline.” That is already happening across healthcare, they wrote.

Ultimately, the $450 million will go toward spreading biology’s presence in all industries, Conde and Pande said.

When searching for start-ups to fund, Andreessen Horowitz wants projects and people with the “ability to engineer biology,” enabling the firm to plan and innovate in a controlled fashion. “This is the point at which one can build a viable, scalable company, not just a research project,” Conde and Pande wrote.

The future comes down to the founders. These wide-eyed innovators must not only develop new ideas and technologies but also forward-thinking business models. They must be equally dedicated to nurturing a strong company, based on the markets, research, their product, and internal culture, according to Andreessen Horowitz. And these days, the authors added, founders with experience in biology, computer science, and other forms of engineering are the ones shaping healthcare to come.

“We believe it is precisely these founders—who can take a broader view while also bringing deep expertise to bear on a specific problem or need—that will build the next generation of iconic bio companies,” Conde and Pande wrote.

And the venture capital group does not plan to sit around and wait: Just this week, it announced $4.7 million in seed funding to Asimov, a computer-driven bio-engineering start-up born at the Massachusetts Institute of Technology that aims to leverage genetic circuits to protect against sickness.